Vision insurance is a health benefit that helps offset the cost of glasses, contact lenses, and eye exams.

If you are unsure how vision insurance plans work, if purchasing a plan is a good idea, or how to use your benefits, all of that will be covered in this article.

What is vision insurance?

Vision insurance is a health benefit that helps patients pay for eye care, such as comprehensive eye exams and prescription glasses and contacts. It is mechanically similar to medical insurance but has a much narrower scope of what is covered. For example, vision plans typically only cover services and products related to vision exams and vision correction.

Vision exams include examining and maintaining the general health of the eyes and prescribing vision correction in the form of glasses and contact lenses. Whether you have vision insurance or not, using our free price comparison tool will help you save money on your contact lenses and glasses.

It’s important to note that vision insurance does not cover visits to the eye doctor for medical reasons. Examples of medical conditions related to the eye include cataracts, strabismus, ocular cancers, glaucoma, dry eye disease, photophobia, and other ailments. However, medical conditions of the eye are typically covered as part of standard health insurance plans.

How does vision care insurance work?

Like health insurance, patients pay a set monthly premium to participate in the vision insurance plan. The monthly premium is the fixed payment that you make for the benefit. Your premium payment is typically automatically withdrawn from your paycheck if you signed up for your vision plan through work.

Depending on what the vision plan entails, the vision insurance can be used to cover a percentage of fees for eye exams and glasses or contacts. The vision plan tells the provider how much to charge the patient for services and products. The provider then bills the insurance for the services provided to the patient.

Different vision insurance plans have different prices and coverage allowances. Some vision plans may cover everything, while others may cover a percentage or provide a set allowance for things. For example, a vision plan may grant the patient a $100 allowance towards contact lenses, and the patient will have to pay out-of-pocket for any balance.

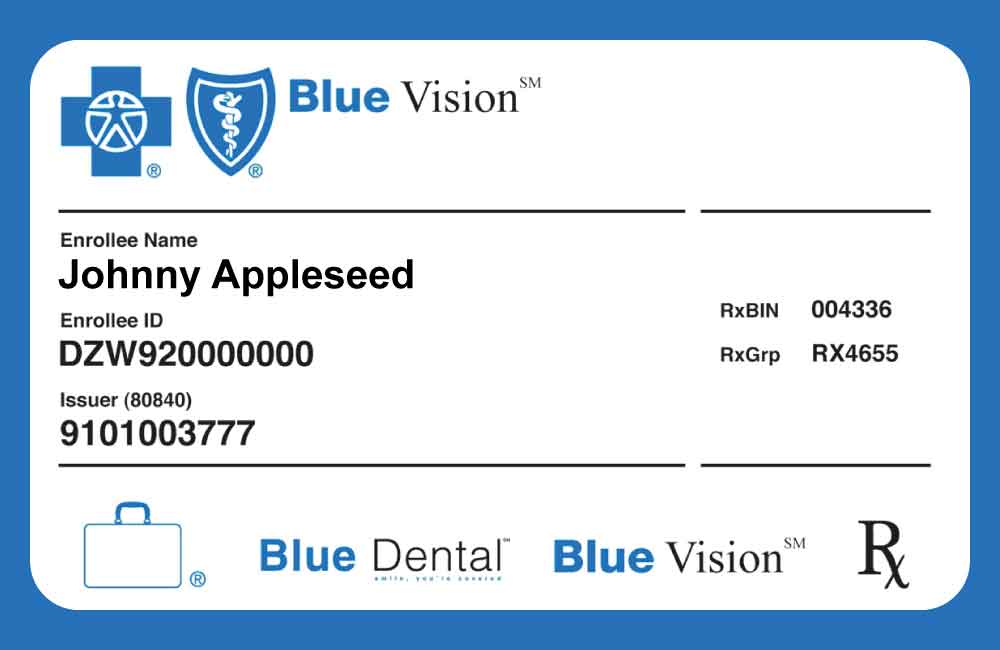

If you are signing up or have benefits but are unsure about the details, ask for an explanation of benefits card to review all of the details.

How to get vision insurance

If you are not offered vision benefits at work, you can shop for a plan that is right for you.

If you are employed and offered medical insurance, you can usually also enroll in vision insurance through your employer. Depending on the plan and what your employer agrees to cover, you will pay monthly to maintain your vision insurance. It is most often deducted from your monthly paycheck, like your health insurance premium.

Remember, you do not need to have medical insurance to have vision insurance, or vice-versa. Vision plans are available to anyone who would like help covering their vision-related expenses. After choosing a provider, one can pay a monthly premium or pay for the entire year of coverage upfront.

How much does vision insurance cost?

Depending on your employer and the available plans, vision insurance can cost anywhere from $5 to almost $45 per month. Additionally, some plans require a co-pay for services and optical materials, so these costs should be considered. In other words, a patient may be required to pay a co-pay for their eye exam and a separate co-pay for an anti-reflective coating on their prescription glasses. For this reason, it’s essential to read the fine print and ask questions if you are not sure what the total cost of a visit will be.

With that being said, each vision plan is different, and one program may be more suitable for some people than others. It is crucial to explore all of your options to choose a vision plan that best suits your needs, if at all.

What is covered by vision insurance?

In general, vision insurance covers annual comprehensive eye exams, including a refraction (the process of getting your glasses and contact lens prescription). In addition to the eye examination, there is some coverage for frames, prescription lenses, and contact lenses. Typically, vision plans will cover either the price of contact lenses or glasses each year. Not both.

Some vision plans may cover the entire price of glasses or contacts, or cover a percentage or set dollar amount. The price after the insurance coverage will have to be paid by the patient. Additionally, some vision plans may offer some coverage or discount for refractive surgery like LASIK.

If you have an FSA or HSA account for healthcare spending, you can also use those dollars to help pay for your vision needs.

Does vision insurance cover contact lenses?

Yes, most vision insurance plans offer coverage for contact lenses. Some plans may cover 100% of the price for contact lenses for a year, while some may offer an annual allowance to use towards the cost of contact lenses. If there is a remaining balance after the allowance from insurance, that cost must be paid by the patient.

There are some contact lens companies that offer rebates to patients for buying a year’s supply of contact lenses at once. That is also something to consider when deciding if using vision insurance for contact lenses is the best option. Learn about Acuvue rebates, Alcon Rebates, and CooperVision Rebates.

Common Vision Insurance Plan Limitations

Each vision plan has a network of providers that accept their coverage, so going to an out-of-network provider may not accept the vision insurance at all. Some vision plans have some coverage for out-of-network providers, but not all of them. That coverage may also be limited.

Other limitations of vision insurance are outlined in what they agree to cover based on your specific plan. Vision insurance companies can exclude certain brands of frames or only cover frames up to a certain price point. Also, certain lens specifications may be limited as well. For example, they may only cover a basic progressive lens, not the top-tier choice.

The same goes for contact lenses as well. Some contact lens brands may not be covered by certain vision insurance plans. Also, most plans do not cover both glasses and contact lenses in the same year.

Eye surgeries are often not covered by vision insurance. Some plans offer coupons or discounts for refractive surgery like LASIK, but not all of them. Additionally, surgeries that are considered medical or cosmetic are not covered by vision insurance either.

Is vision insurance worth it?

It sounds like vision plans have many exclusions, and since my health insurance covers medical problems of the eye, is vision insurance even worth it?

It depends. Vision insurance can make a big difference in cost for people who need vision correction. Sometimes, vision insurance can cover the entire cost of annual eye exams and prescription lenses.

On the other hand, people who do not need vision correction and only get annual eye exams to maintain their eye health may not need a vision plan. The out-of-pocket fees could end up being less expensive than the cumulative total of paying for vision insurance monthly.

To determine whether this will be worth it for you, you’ll have to calculate what the out-of-pocket cost would be for you to pay cash for an eye exam and your glasses or contact lenses. Once you know what that cost would be, you should compare it to the cost with vision insurance. Don’t forget to include the cost of premiums and any co-pays.

For example, vision insurance will pay for itself if you pay $10 per month for benefits (a total cost of $120) but receive a free eye exam ($60 value) and $125 toward contact lenses. So for the price of $120, you are essentially getting $185 worth of value.

You’ll want to do a similar calculation for your specific plans to see if it makes financial sense for your family or not.

One nuance is that if your vision insurance benefits are purchased via your job and come from your paycheck, you are paying for it pre-tax. This means that you’ll save a little bit of money on your taxes by lowering your taxable gross income. It likely won’t be a considerable amount, but every dollar helps.

Does Walmart accept vision insurance?

Walmart is an Out-Of-Network provider for the following vision insurance companies:

- VSP

- Cole Managed Vision

- Davis Vision

- EyeMed

- Spectera

Walmart Associates (employees) can participate in a plan that offers annual eye exams for $4 and either a frame allowance of $130 with $4 lenses, or a contact lens allowance of $130. That means that customers get a $130 credit towards their contact lens order, and they have to pay the balance out-of-pocket.

These prices do not include the co-pay determined by VSP for the eye exam and contact lens fitting. The contact lens fitting fee, which is required to be prescribed contact lenses, can be up to $60. Also, this vision plan does not cover any prescription glasses or contacts that are from an out-of-network provider.

As stated earlier, for non-employees, Walmart will accept some other insurance companies, but they are considered out-of-network. Those insurance companies are: Cole Managed Vision, Davis Vision, EyeMed, Spectera, and certain VSP plans. Customers with these vision plans must fill out a form and provide an invoice to mail to their insurance company to apply for reimbursement.

Does 1-800 Contacts accept vision insurance?

Yes. They accept the most popular vision care plans and are considered in-network for these plans: Anthem, Blue View Vision, Davis Vision, Superior Vision, Spectera, and United Healthcare Vision. They are considered out-of-network for these plans: Aetna, EyeMed, Humana, and VSP. However, 1-800 Contacts will still accept some benefits from those plans to save customers money. In that case, customers complete a claim form and submit an invoice for reimbursement.

Remeber that while 1-800 Contacts is the best-known online store for contact lenses, they often charge higher prices. You can see which site has the most competitive price for your contacts by using our price comparison tool. It’s free, easy, and can save you loads of money.

Does Costco accept vision insurance?

Yes. Costco accepts most vision insurance plans. While there are many Costco locations, each store may vary in what vision insurance they accept. It may be a good idea to call your neighborhood Costco in advance to verify that your vision insurance is accepted. These insurance plans are commonly NOT accepted by Costco: Aetna, EyeMed, Humana, and Tricare.

Costco owns its own optical shop, which sells frames, prescription lenses, sunglasses, contact lenses, and accessories. They offer contact lenses from many major manufacturers such as Coopervision, Alcon, Bausch & Lomb, and Johnson & Johnson. A current valid prescription is required for purchase. Additionally, a Costco membership is also required to make any purchases from Costco Optical.

Most of their products are available to purchase in-store, but only their contact lenses are available to purchase online from their website. Online orders are not eligible for vision insurance coverage. Also, vision insurance does not cover their sunglasses.

Customers can visit Costco Optical to get their prescription filled from an outside Optometrist, or they can visit the Independent Optometrist that leases office space from Costco. Since the Optometrist is not affiliated with Costco, they may not accept the same vision insurance as the optical shop. They may not accept vision insurance at all.

Camilo is the founder of Contacts Compare and is a contact lens enthusiast who has been buying, shopping, and comparing contact lenses for over 12 years. He started Contacts Compare because it was nearly impossible to compare prices quickly to make sure he was getting the best price possible. He holds degrees from Harvard University and the University of Pennsylvania. His favorite contact lens is Acuvue Oasys 1-Day with Hydraluxe.